Credit Karma has been around for a long time and has consistently added a variety of services that may be useful in your day to day financial life.

At its core, Credit Karma is an online credit score monitoring service that enables you to access your credit scores at any time. They’ve been around for a few years, and the service is advertised almost everywhere (I still remember the first TV commercials).

“Free credit scores” is an appealing offer, but also one that has people wondering if they’ll be forced to sign up for something later on, but is it legit?

Here’s what they offer:

Table of Contents

🔃Updated February 2023 with a fresh review of Credit Karma, including new screenshots and features. There were a lot of updates to Credit Karma’s offering such as daily score check vs. the previously 30 day checks.

What is Credit Karma?

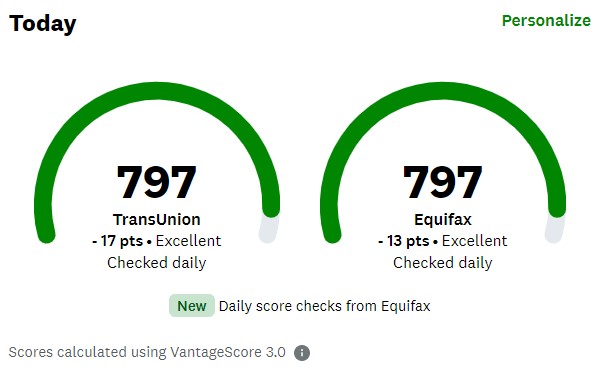

Credit Karma is a credit score monitoring system that makes money by promoting financial products suitable for your credit score. The scores they report are from TransUnion and Equifax credit bureaus and use the VantageScore 3.0 scoring model.

These days, there are many sources of free credit scores. But most of those sources will provide you with access to your score from only one of the three major credit repositories – Equifax, Experian or TransUnion. Credit Karma gives you access to credit scores from two.

Also, remember that you are legally entitled to get access to your credit reports from each of the three bureaus from AnnualCreditReport.com. You only get reports, no scores – so if you want that, Credit Karma is a good service to use.

Credit Karma got its start in 2008 when it made credit scores free for anyone who would sign up for the service. They now have more than 60 million members using the service.

How Does Credit Karma Work?

When you sign up for Credit Karma, you get daily monitoring of your report on TransUnion and Equifax. These scores will both be available for presentation on your Credit Karma Dashboard page. The scores are updated daily.

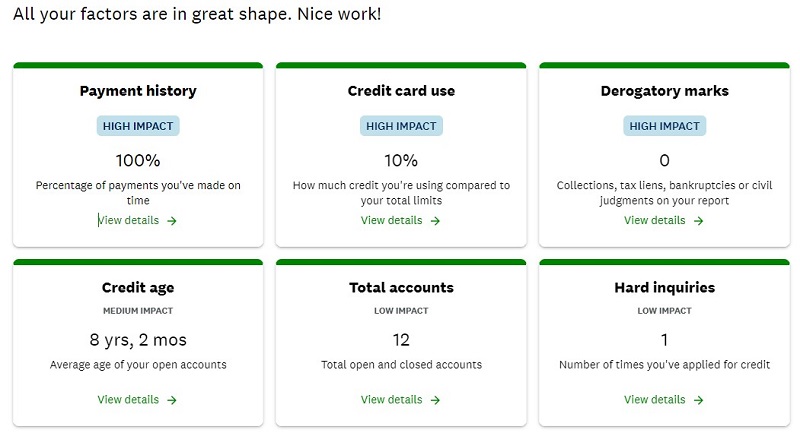

You can then click over to the “Score Details” page, which will provide you with the reasons why your credit scores are what they are. This will include six of the factors that are used to calculate your credit score, including their “impact”:

The factors are:

- Credit card use

- Payment history

- Derogatory marks

- Credit age

- Total accounts

- Hard inquiries (which are lenders actually pulling your credit report)

Under each category, you can see details of each factor. You can see credit card outstanding balances reported in your credit report, your actual loan payment history over the past several years, and a list of any derogatory information, including public records.

The detailed information provided by Credit Karma includes most of the information that will be available on an actual credit report but it’s organized a little nicer. The credit bureau reports aren’t the most readable.

Credit Karma also provides suggestions on how to improve each category, including methods to dispute the information contained in your credit report.

Credit Karma Features

Credit Karma isn’t just about credit scores – it’s about everything that’s related to them. The features that come with the platform provide assistance and tools that will help you in virtually everything in your life that has anything to do with credit.

My Recommendations. This feature provides you with lending suggestions based on your credit profile. Credit Karma will display one or more loan opportunities that you are likely to qualify for. These loans will enable you to consolidate your debts, so that you can save money on interest, or pay off your debts more quickly. The lender list will include not only the interest rate and terms, but also what Credit Karma believes will be the likelihood of loan approval.

Credit Card recommendations. Credit Karma will provide a list of credit cards that are available based on your credit profile. The cards can be displayed based on different categories, such as lowest interest rates, rewards, cash back, airlines or the best cards for balance transfers.

Loan recommendations. Once again based on your credit profile, Credit Karma will present lists of the best lenders available for personal loans, home loans, auto loans, student loans and business loans. There is also a dedicated auto loans page, that will give you access to the best lenders to either take a new auto loan with or refinance an existing one. They even present you with the best offers available for auto insurance.

Credit tools and calculators. Credit Karma has a large selection of tools to help you manage your credit. This includes tools to help you to improve your credit situation or to get out of debt. They also have calculators that enable you to determine in advance how a loan might help you. This includes their Mortgage Refinance Calculator, Debt Repayment Calculator, Simple Loan Calculator, and loan Amortization Calculator. The debt consolidation resource can help you to determine the benefits and drawbacks of credit counseling, bankruptcy or debt consolidation strategies.

Perhaps the most useful credit tool is the Credit Simulator. This tool enables you to determine what certain changes in your credit profile will do to your credit score. For example, you can determine how much a late payment will hurt your score, or how much paying down debt will improve it. This is a valuable tool for anyone who is looking to actively manage their credit scores.

How Much Does Credit Karma Cost?

Credit Karma is free.

Does that sound like a gimmick?

It’s not. Credit Karma makes money by recommending financial services and products they think you need.

If you agree to take a loan from one of those lenders, Credit Karma receives compensation from the lender. If you apply for life insurance, they get paid. If you apply for auto insurance, they get a commission.

When you open a credit card, they get a piece of the action. They’re very transparent about it and it helps users understand why they’re free.

There’s no surprise “gotcha” fee later on – Credit Karma is free.

Best of all they also pledge to never sell your information to marketers.

Is Credit Karma Safe?

Credit Karma uses 128-bit or higher encryption during transmission of data (which is standard, check for the lock icon in the address bar). They also encrypt data at rest.

Credit Karma can be especially beneficial for anyone who is looking to build or improve on their credit score. Not only does it provide you with ongoing access to your credit scores, but also to your credit report information. This gives you an opportunity to see if there are any errors in your credit profile that you may need to correct.

What’s more, they provide you with the tools that you need to make those credit score improvements. They can tell you if you need to improve your credit history, lower the amount of outstanding debt that you have, or even consider your options to do a debt consolidation through a lower cost lender.

And since virtually everyone can experience credit difficulties at some point in life, having access to a service like Credit Karma will give you the tools that you need to deal with it when it happens.

Credit Karma is a service that’s good for anyone to have, even if you’re not particularly interested in tracking your credit score. Credit scores aside, when you’re ready to borrow, Credit Karma will help you to find the lenders that will work best for your credit situation.

Credit Karma packs too many resources in one free service to pass up.

Jack says

Absolutely correct!! Not a FICO score. Whenever I have gone to purchase something via credit, THEY always use the FICO! To purchase a home, a car or anything of importance they use FICO. My son, a mortgage banker said that they never use anything but FICO.

Why am I so upset about this. I went to purchase a new car. My CreditKarma/ Credit.com/Creditsesame each had my score at 750. FICO had my score at 677! Guess which one the dealership used? You got it. I had to pay 2% points more if I bought their car. ALL dealerships use FICO. Not worth anything else. Sorry.

DNN says

I was commenting on another blog early this morning about credit scores. I’m mindful to pay my credit card bill ahead of time and only late once in a blue moon. I’m not far right now from reaching 850 which is the highest credit score anyone can have in America. Reason being that I pay my credit card bill ahead of time is to have an excellent credit history so that if in the random event I accidentally slip on my credit bill and don’t pay it in time, the credit card company will have mercy on me because of my past payment history.

James C. says

You don’t get rewarded for what is expected of you! ….”have mercy”, are you really that naive?

David J. Bauman says

I want to know if the author of this article has actually used the Credit Karma service. His “review” reads like a paid endorsement. If I missed a disclaimer that said he was in no way compensated for this review, I sincerely apologise. But being a skeptic, asking questions, and doing your research is how you find real answers.

My experience was totally different from the previous commenter Jack. In my case, it turned out that Credit Karma was giving me an “estimate” that was drastically lower than the truth. I was appreciating the “free” service and information and came close to applying for a credit card for one of their advertisers.

Thankfully, I did not because in reality my Esperian score was a full 218 points higher than the CK estimate, putting me solidly in the good range.

Credit Karma advertises high-interest and secured cards that would have had me paying far more in interest than my actual credit rating called for. They can give all the good, sincere-sounding advice in the world, but they are not working for you. They are working for their advertisers. In my case, how can I possibly believe that Credit Karma’s tactic was anything other than to tell me I had a low score so that they could steer me toward a high interest rate with one of the companies who makes them money?

This is why I believe that if they are not a scam, they are at least a very smooth, savvy, sincere-sounding, legal con (which is what this review also sounds like). The best possible scenario is that they are just grossly inaccurate and unable to do what to do what they say they will do.

FWIW, Kevin, the article’s author, has used it and he was compensated by me (Jim) because he’s a staff writer for Wallet Hacks. The the screenshots are of my (Jim) account and am not getting compensated for this review.

David J Bauman says

Great. Im glad to hear that. But you’ve ignored 80% of my comment. The main reason I questioned the potential bias of this review, aside from it being rediculously positive, with almost zero negativity (I’ll get back to that in a moment), was my personal experience with Credit Karma. They seem legit. Everything they do appears to be legal, but if they are so marvelous, how in heavens name could they estimate my credit score to be a full 218 points lower than it actually was? The most logical conclusion is they do that in order to stear me toward the high interest credit cards and loans of their advertisers.

That might be legal, but it isn’t right. Its not in my best interest. And it’s one doozy of a “mistake.” Can you see why I’m suspicious?

Back to the review itself. The trend among poetry writers these days is to compose glowing reviews of their friends’ books in order to help boost their friends’ sales. Im sorry, but that’s what this “review” sounds like. It does not at all come across as a fair and balanced assessment of a product or service. At the very end he lists two cons and does not elaborate. Really? Less than two lines of critique? That’s not enough to prevent this review from sounding like a glowing advertisement or endorsement.

Since CK admits to making revenue when their users take out a loan or credit card from their advertisers, and Mr. Mercadante has written a beautiful hymn of praise to Credit Karma instead of a considered product review, how can you not expect me to wonder if you might just work with the same advertisers as they do, or if someone at CK is a good friend whose products you’re helping to sell?

Why not address or discuss potential reasons for a 218 point miscalculation on their part? Surely I’m not the only one who this has happened to.

I personally have on had positive experiences with Credit Karma but I also didn’t have a 218 point discrepancy.

First, CK reports your VantageScore, which is different from the FICO score.

Next, they also use TransUnion and Equifax data, not Experian.

So the discrepancy could be explained by two things, the use of a different score and different data set. Were both scores (TransUnion VantageScore and Equifax VantageScore) both off by 200+ points or just one? Were the reports 100% accurate and identical to Experian or was there some data missing in one (or data appearing that shouldn’t be there)?

Lastly, if a company wanted to steer you towards anything, they can do it without showing you an inaccurate score. They can show you your score and still show you the higher commission credit cards. I’m not saying they aren’t showing you a bad score, I believe you when you say they did, but I suspect the reason behind it is not nefarious.

Thomas R Borgers says

Is this your email:

they request that I send them my drivers license and social security card?

Credit Karma Member Support

I have never sent them that information before, that’s probably not them.